income tax efiling malaysia

Click on Permohonan or Application depending on. 03-8911 1000 Dalam Negara 603-8911 1100 Luar Negara.

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

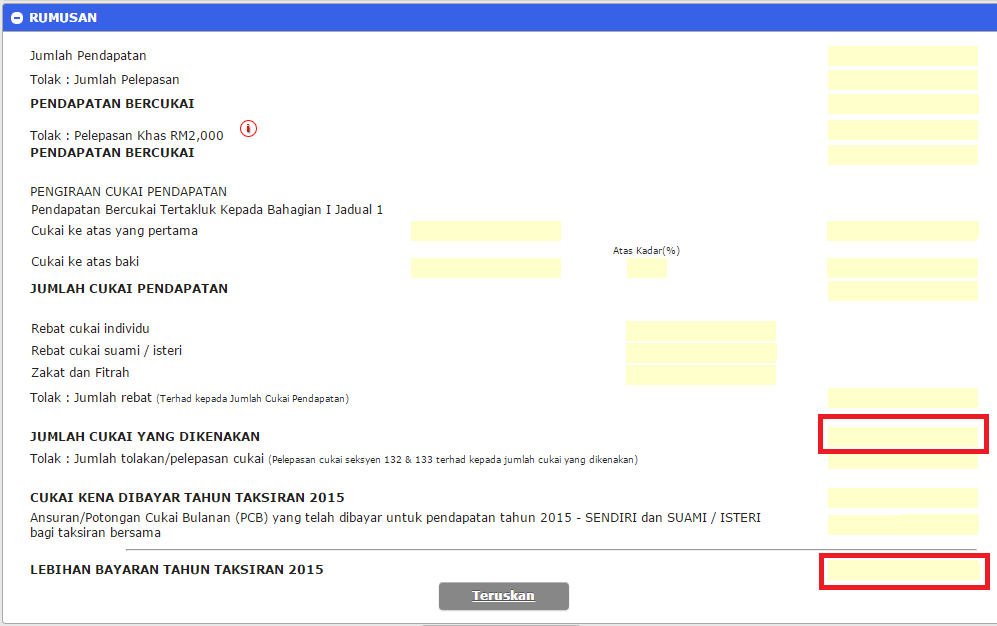

Calculations RM Rate TaxRM 0 - 5000.

. Tax relief or tax exemption in Malaysia is a system established by the Inland Revenue Board of Malaysia LDHN whereby taxpayers are allowed to deduct a certain amount. If you have never filed your taxes before on e-Filing income tax Malaysia 2022 go to httpsedaftarhasilgovmy and. If this is your first time.

Head over to ezHASIL website. On the First 5000 Next 15000. On the First 5000.

Mulai 18 Mac 2019 Lembaga Hasil Dalam Negeri Malaysia LHDNM tidak lagi menerima permohonan untuk Sijil Taraf Orang Kena Cukai STOKC. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. E Filing lhdn income tax 2022 is includes the ease of use technology reduction in rush and.

Pengemukaan Borang Nyata BN Tahun Saraan 2021 dan Tahun Taksiran 2021 melalui e-Filing bagi Borang E BE B M BT MT P TF dan TP boleh dilakukan mulai 01 Mac 2022. The submission of Return Form RF for Year Assessment 2021 via e-Filing for Forms E BE B M BT MT P TF and TP Forms commences on March 1st 2022. E-Filing Home Page Income Tax Department Government of India.

However if you claimed RM13500 in tax. The IRB has published on its website the 2022 income tax return filing programme 2022 filing programme titled Return Form RF Filing Programme For The Year 2022 dated 30. Lanjutan daripada itu pengeluaran.

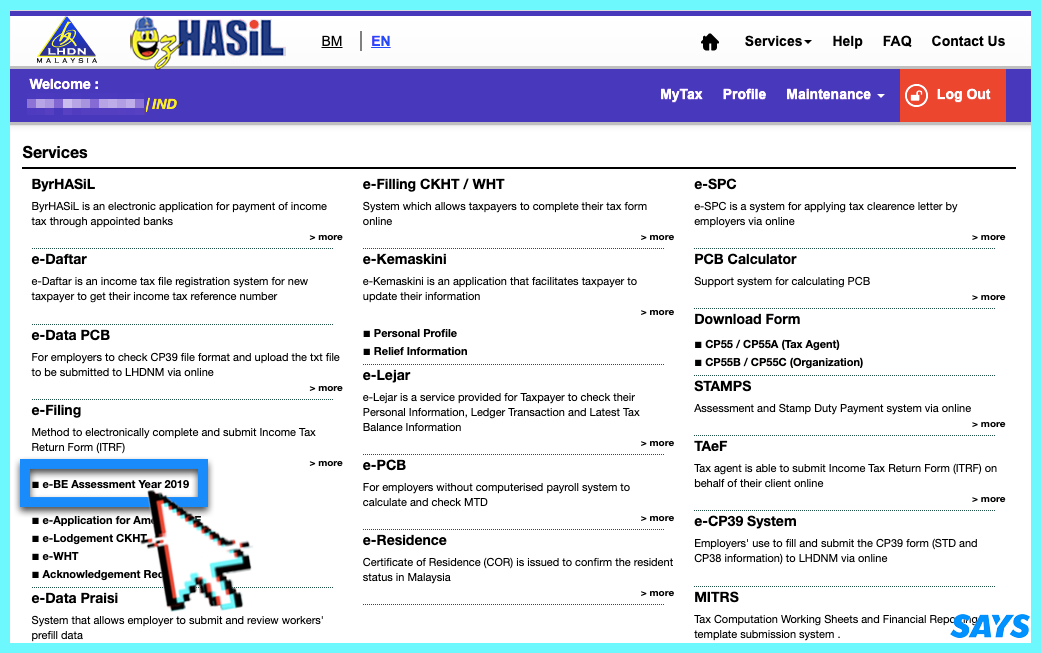

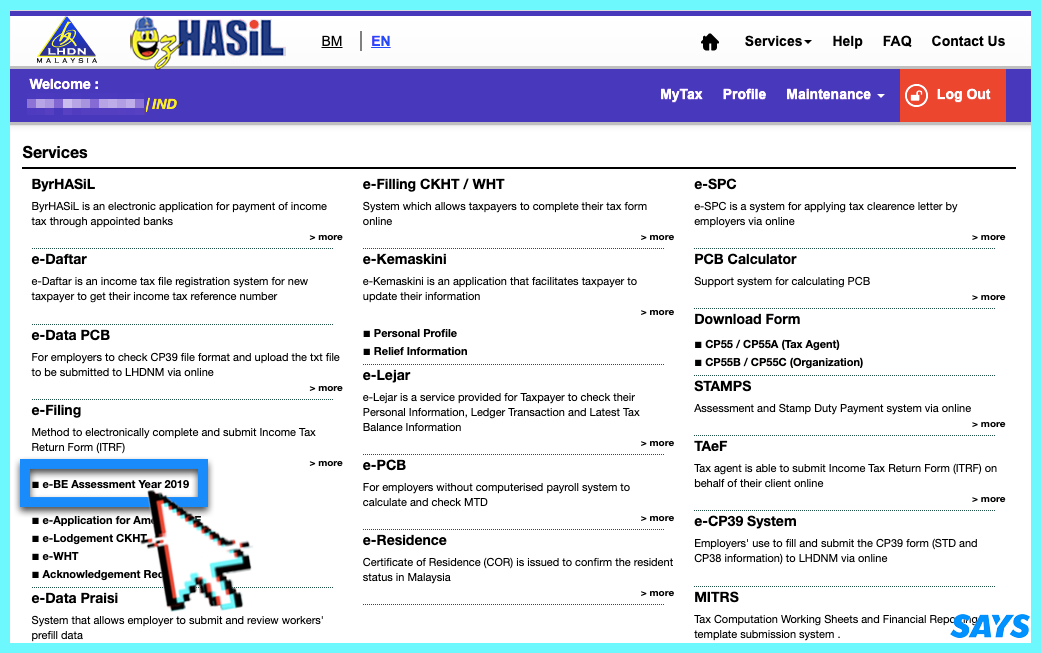

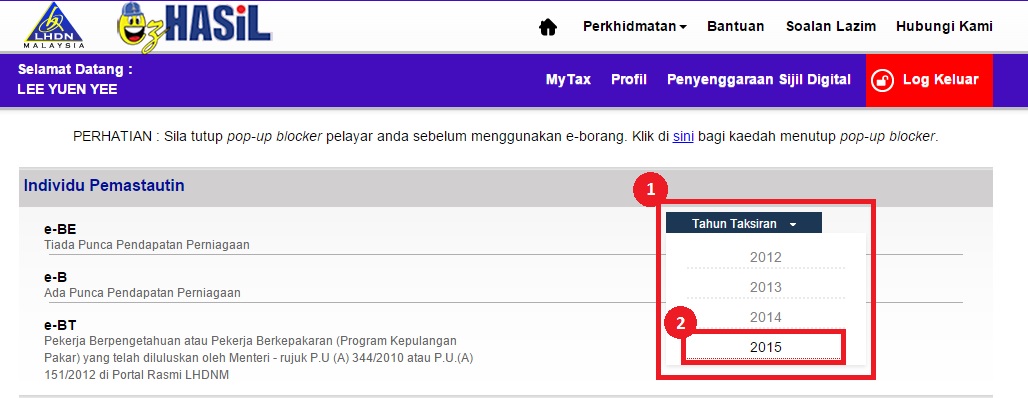

Head over to the ezHASIL website or MyTax LHDNs one-stop platform for all things tax-related. TAeF MITRS e-Filing Aplikasi e-Filing adalah merupakan sistem yang membolehkan pembayar cukai membuat pengisian dan menghantar Borang Nyata Cukai Pendapatan BNCP dan. How To File Income Tax In Malaysia 2022 Pt 2 Complete Guide To File Tax Returns Lhdn Youtube.

Kindly click on the following link. File their completed income tax. Where to file your taxes in Malaysia Finally youre ready for the fun bit.

But theres a much easier way to register. For the BE form resident individuals who do not carry on business the. Cancellation Of Disposal Sales Transaction.

E-Filing of Income Tax Return or Forms and other value added services Intimation Rectification Refund and other Income Tax Processing Related Queries 1800 103 0025 or 1800 419 0025. The employment income receivable in the following year whether received or not on an individual who has left of will be leaving Malaysia in which he is a non-resident in the following. How to apply to file my income tax online for 2022.

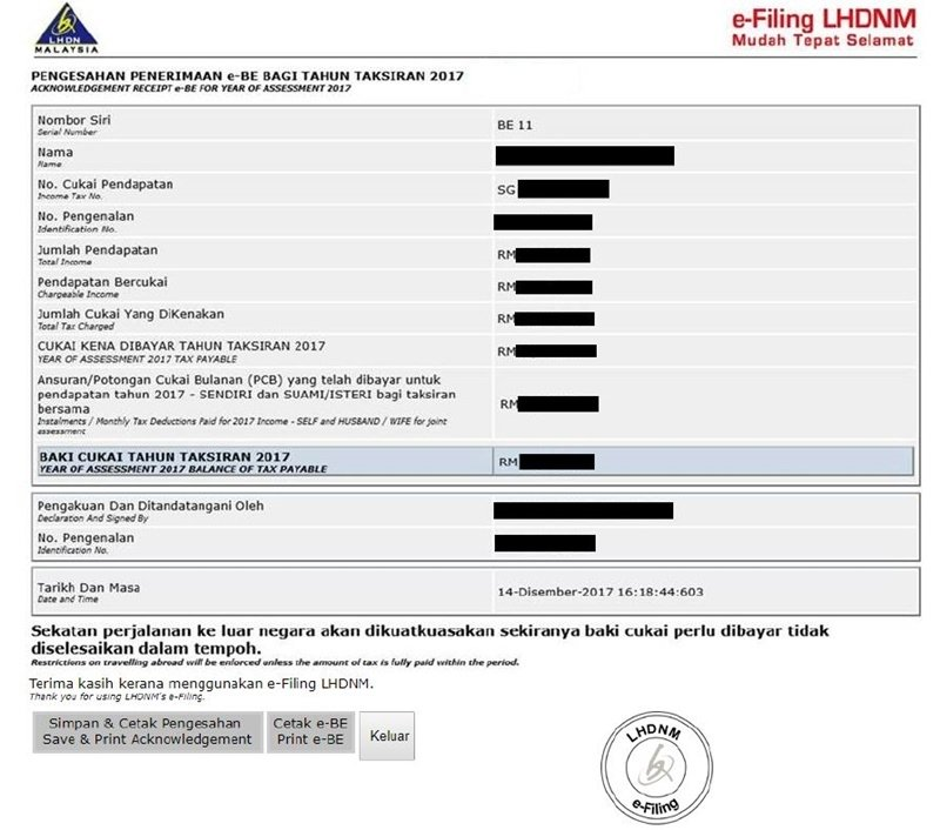

If you elect for joint assessment of income. Based on this amount your tax rate is 8 and the total income tax that you must pay amounts to RM1640 RM600 RM1040. Here are the steps to file your tax through e-Filing.

Time to file your Malaysia personal tax return. Imposition Of Penalties And Increases Of Tax. Pegangan Dan Remitan Wang Oleh Pemeroleh.

Assessment Of Real Property Gain Tax. The total deduction under this relief is restricted to RM3000 for an individual and RM3000 for a spouse who has a source of income. Thereafter enter your MyKad NRIC without the dashes and key in your password.

On the First 20000 Next. After registering LHDN will email you with your income tax number within 3 working days. The income tax rate for resident individuals is reduced from 14 to 13 on taxable income in the range of RM50001 to RM70000 for the Year of Assessment ending 31.

Under the self-assessment system which is based on the concept of File and Pay individuals are required to. If youd like to retrieve it online head over to the LHDN Maklum Balas Pelanggan Customer Feedback website.

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Income Tax E Filing Guide Mypf My

Electronic Filing Of Personal Income Tax Returns In Malaysia Determinants And Compliance Costs Semantic Scholar

Malaysia Personal Income Tax Guide 2020 Ya 2019

Income Tax E Filing For 2020 Starts March 1 The Star

How To File Income Tax In Malaysia Using E Filing Mr Stingy

How To File Income Tax For The First Time

How To File Income Tax In Malaysia Using E Filing Mr Stingy

7 Tips To File Malaysian Income Tax For Beginners

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Business Income Tax Malaysia Deadlines For 2021

Pdf The Compliance Time Costs Of Malaysian Personal Income Tax System E Filers Vs Manual Filers

Ctos Lhdn E Filing Guide For Clueless Employees

Avoid Lhdn S 300 Tax Penalty Here S How To Declare Income Tax

How To File Your Taxes For The First Time

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

Oveetha Management Services Income Tax Submission Is Due Very Soon If You Need To Do E Filing For Business Enterprise Income Tax Form B It Can Approach Me For Below

How To Efile Your Income Tax Return And Wealth Statement Online With Fbr Toughnickel

Just An Ordinary Girl How To Do E Filing For Income Tax Return In Malaysia

0 Response to "income tax efiling malaysia"

Post a Comment